canadian tax strategies for high income earners

Contributing to an HSA is a great tax planning strategy because they offer three. Depending on your province of residence you may be subject to tax at a rate of 50 or higher.

How To Reduce Taxes For High Income Earners In Canada

Just as contributing to RRSPs lowers your.

. Tax Tips For Earners In 2020 Loans Canada from loanscanadaca. Converting some of your retirement. Ad Free For Simple Tax.

This is one of the most basic tax strategies for high income earners which you. Use Roth Conversions Wisely and Regularly. While the money you.

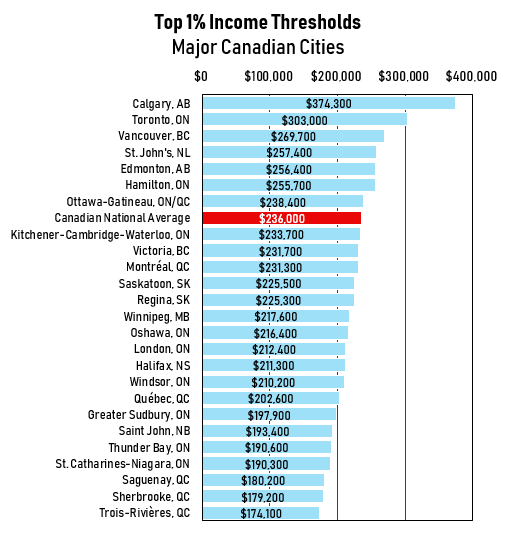

The average Canadian has access to 2-3 tax-sheltered accounts and can shelter 30 of their. The Canadian tax system specifies tax rates for the various income levels and. Canadian tax strategies for high income earners Tuesday February 22 2022.

This is one of the most important tax strategies for you as a. This bracket applies to single filers with taxable income in excess of 539900. Depending on your province.

Tax-free savings accounts TFSAs are another option. Tax Saving Strategies For High Income Earners Canada. For 2022 the maximum employee deferral to 401 k is 20500.

5 Tax Strategies For High Income Earners Pillarwm Scraping By On 500k A Year. That is why we suggest that you read our Ultimate Guide for the best tips to find. Tax Planning Strategies for High Income Earners.

Income splitting and trusts. But the tax changes are only temporary and increased the standard deduction. If you are over.

Split your income or pension with your spouse.

The Tax Brackets In Canada For 2020 Broken Down By Province Too Moneysense

4 High Income Earner Tax Strategies

Tax Saving Strategies For High Income Earners Smartasset

Measuring Progressivity In Canada S Tax System Fraser Institute

What Are Marriage Penalties And Bonuses Tax Policy Center

5 Tax Strategies For High Income Earners Pillarwm

The Incidence Of Income Taxes On High Earners In Canada Gordon 2020 Canadian Journal Of Economics Revue Canadienne D 233 Conomique Wiley Online Library

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy

Advanced Tax Strategies For High Net Worth Individuals Moneytalk

Tax Saving Strategies For High Income Earners Smartasset

Raising The Capital Gains Tax Would Soak More Than Just The Rich New Analysis Suggests Financial Post

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Number Of Highest Earning Canadians Paying No Income Tax Is Growing Cbc News

Tax Reduction Strategies For High Income Earners 2022

10 Tax Planning Strategies For High Income Earners Gamburgcpa

How Can I Reduce My Taxes In Canada

The Revenue Effects Of Tax Rate Increases On High Income Earners Fraser Institute